What’s a credit score?

There are few numbers in life that matter as much to your financial health as your credit score. Your credit report and rating compose a financial snapshot that presents you to the business world. Your financial history can affect how easily you can get a mortgage, rent an apartment, make big-ticket purchases, take out loans, rent a car, and even get hired in some industries.

Your credit score is a three-digit number that relates to how likely you are to repay debt. It has nothing to do with how much money you make. This number can go a long way in determining whether a lender will approve you for a credit card or loan and the interest rate you will be charged. I can’t stress enough how important your credit scores will be throughout your entire life.

You actually have more than one credit score. The three major consumer credit bureaus – Equifax, Experian and TransUnion – each create credit reports and scores that contain important information about your credit accounts and financial profile. There are slight variations among the bureaus, but credit scores are always three-digit numbers, typically from 300 to 850. The scores are derived from information in the full credit report, including the person’s payment history, amount of debt outstanding, length of credit history, credit mix, and number of recent applications for new credit. Equifax and Experian provide detailed credit histories that include items like outstanding liens and collections, mortgage history and the exact month of any late payments. Transunion provides more insight into job history.

Scores can be different across the three bureaus because creditors aren’t required to report to all three credit bureaus (it costs them money) and might report to only one or two. The bureaus each have their own frequency and timing for compiling data, so scores may differ depending on the day of the month the data was collected. Residential mortgage companies usually report to all three bureaus.

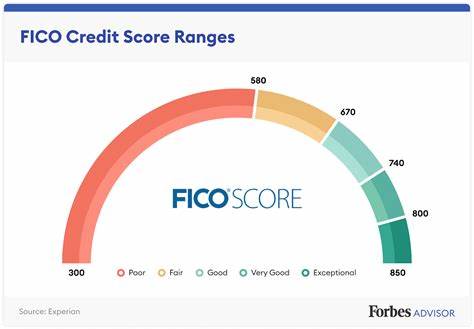

Different lenders use different scoring models. Since mortgage lenders use the FICO score, we will focus on that. FICO is an acronym for Fair Isaac Corporation, which created the proprietary algorithm used to calculate credit scores from all three credit bureaus. FICO Scores range from 300 (extremely high risk) to 850 (extremely low risk). Having a high score increases your odds of getting approved for a loan and helps with the conditions of the offer, such as the interest rate. Having a low FICO Score can be a deal breaker for many lenders or result in a higher borrowing cost. More banks and lenders use FICO to make credit decisions than any other scoring model.

Your credit score is based on five differently weighted elements:

- Payment History – paying your bills on time is the most important element in your credit score. Its importance is weighted at 35%.

- Credit Utilization – How much of your available credit you are using is weighted at 30%. Consumers should strive to use 30% or less of their available credit.

- Length of Credit History – This is weighted at 15% and is the length of time the accounts on your credit report have been established.

- Credit Mix – Consumers need various types of debt – mortgage, auto loans, revolving debt, etc. This is weighted at 10%.

- New Credit – FICO frowns on borrowers who recently opened new accounts because it signals that more credit is about to be accessed and used. This element is weighted at 10%.

What’s Considered a Good Credit Score?

According to Consumer Reports a credit score in the mid to high 600s is considered good. Consumers with a credit score below 600 typically have a harder time getting loans and apartments. Mortgage lenders like to see numbers in the 700s to secure a favorable interest rate, and FICO scores of 760 or higher qualify for a mortgage lender’s lowest rates.

According to Consumer Reports a credit score in the mid to high 600s is considered good. Consumers with a credit score below 600 typically have a harder time getting loans and apartments. Mortgage lenders like to see numbers in the 700s to secure a favorable interest rate, and FICO scores of 760 or higher qualify for a mortgage lender’s lowest rates.

How Can I Improve My FICO Score?

If you have an average credit score or worse, it’s worth taking steps to improve it. Follow these steps to improve your FICO score, but be patient because improvement happens over time.

- Pay on time, every time. Late and missed payments are the #1 reason scores are lowered. This practice will have the most impact.

- Lower your credit utilization. Stop maxing out your cards every month, even if you pay them off in full each month. Aim for no more than 30%.

- Monitor your credit report. This will help identify any errors that impact your score so you can take steps to correct them. You can check your credit report from each of the three credit bureaus once per year for free at annualcreditreport.com.

- Get a secured credit card, but make sure it reports to all three credit bureaus.

- Don’t close credit accounts after they have been paid off. This will lower your total available credit and impact your credit utilization negatively.

- Speak with a credit counselor to get sound advice. Credit is complicated.

How to Build Credit

Many younger consumers who are recent high school or college graduates don’t have solid credit scores because they haven’t had time to build a credit history. Consumers who pay cash for everything (no loans or credit cards) typically don’t have a credit history either. To build credit follow these steps:

- Become an authorized user on someone else’s credit card account, like a parent or partner. In this case you’re not the primary cardholder and are not responsible for payment but can use the card.

- Find a co-signer with better credit. A co-signor guarantees that you will pay the debt.

- Apply for a secured credit card at your bank, but make sure they report to all three bureaus. The funds you deposit in the credit account serve as collateral in the event you don’t pay the debt. Secured cards typically have much lower credit limits, but it’s a good place to start.

- Apply for a credit card and make sure you pay the bill on time each month. This could be a gas card, department store card, or major credit card.

Few things in life follow you as your credit score does. It provides a snapshot to lenders on how likely you are to pay your debt and has nothing to do with your income. Every time you apply for a car loan, mortgage, cell phone account, cable television, and sometimes even a job, your credit worthiness is being reviewed. Credit is fragile and needs to be used responsibly.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link